If you are considering starting a business in Hong Kong, understanding the registration process and associated costs is crucial. This guide aims to provide you with detailed information on the steps involved, registration fees, and essential considerations for opening different types of companies in Hong Kong.

Table of Content

- Business Registration Fees

- Business Registration Process

- Renewal and Changes

- Refund of Business Registration Fees

- Applying for a Business Registration Certificate

- Submission of Paper-Based Applications

1. Business Registration Fees

a. Limited Company

- Company Registration Certificate (One-year): HK$2,150 (from April 1, 2023)

- Company Registration Certificate (Three-year): HK$5,650 (from April 1, 2023)

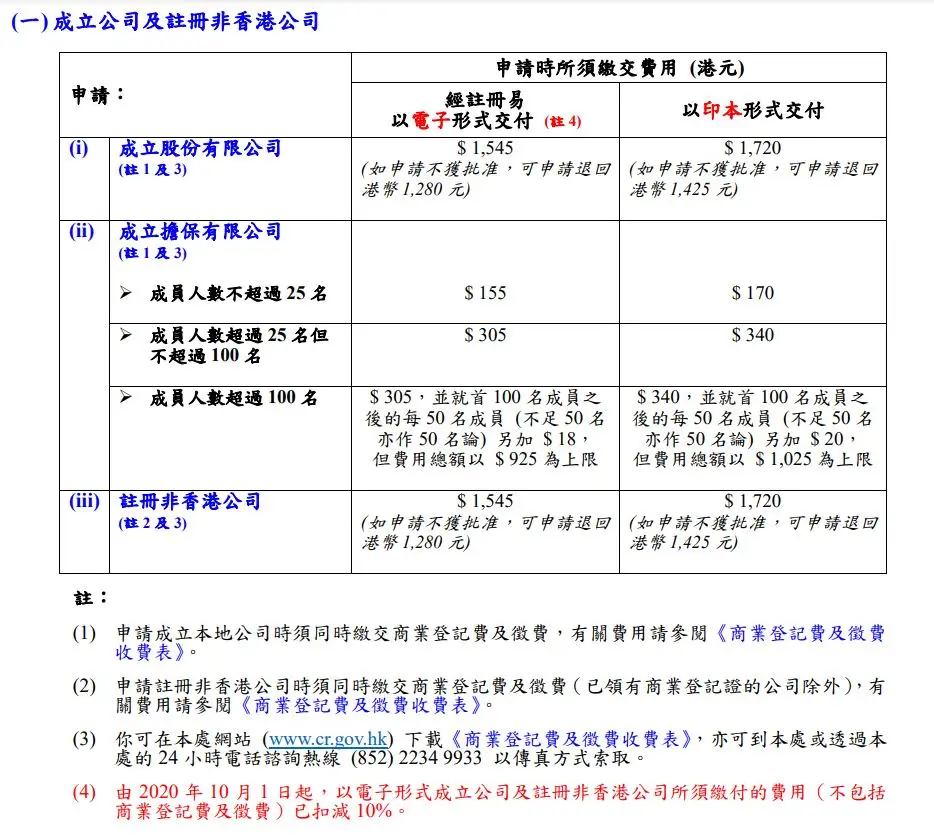

- Government Registration Fee: HK$1,720 (submitted in print) or HK$1,545 (submitted electronically)

b. Sole Proprietorship or Partnership

- Business Registration Certificate (One-year): HK$150 (up to March 31, 2023) or HK$2,150 (from April 1, 2023)

- Business Registration Certificate (Three-year): HK$3,650 (up to March 31, 2023) or HK$5,650 (from April 1, 2023)

- Government Registration Fee: HK$1,720 (submitted in print) or HK$1,545 (submitted electronically)

Note: Business Registration fees may be subject to adjustments by the Business Registration Office.

2. Business Registration Process

When applying to register a limited company, a fee of HK$1,720 is required. In case the registration is not approved, HK$1,425 of the registration fee is refundable, but the HK$295 document storage fee is non-refundable. For limited company registration, the Business Registration Fee is also applicable.

3. Renewal and Changes

a. Renewal

Renewing a Business Registration Certificate is a straightforward process. The Business Registration Office typically issues a payment notice about one month before the renewal month. Upon payment, the notice becomes a valid Business Registration Certificate.

b. Change of Address, Business Nature, or Partners

Any changes to company details, such as address or business nature, must be promptly communicated to the Business Registration Office within one month of the change. The procedures for address changes, alterations to business nature, and partner changes involve submitting specific forms and supporting documents.

4. Refund of Business Registration Fees

As per the “2020 Inland Revenue (Reduction of Business Registration Fees and Branch Registration Fees) Order,” local companies established through a one-stop company registration and business registration process may qualify for a fee reduction of HK$2,000 if the application was submitted during the concession period from April 1, 2020, to March 31, 2021.

5. Applying for a Business Registration Certificate

Whether applying for a sole proprietorship, partnership, or corporation, the process involves filling out the relevant application form, submitting the required fees, and providing necessary identification documents.

- Individual (Sole Proprietorship): Copy of the proprietor’s Hong Kong ID or passport.

- Application Form: Sample application form for individual registration.

- Corporation (Limited Company): Copy of the company’s “Certificate of Incorporation” issued by the relevant government authority.

- Application Form: Sample application form for corporate registration.

- Partnership (excluding Limited Partnership Fund): Copy of Hong Kong ID or passport for all partners.

- Application Form: Sample application form for partnership registration.

6. Submission of Paper-Based Applications

Applicants can either personally visit the Business Registration Office in Wanchai or mail their application to P.O. Box 29015, Gloucester Road Post Office, Hong Kong. Ensure sufficient postage on mailed applications.

This guide serves as a comprehensive reference for navigating the process of opening and maintaining a business in Hong Kong. Stay updated on fee adjustments and procedural changes by referring to the official Business Registration Office website.

Leave a Reply